When considering a merger or acquisition (M&A) as part of a business strategy, timing is everything. The right moment to initiate an M&A transaction can significantly affect the outcome, whether it’s maximizing the company’s value, securing a smooth transition, or protecting against future decline. Business owners often face a crossroads when making this decision, and the timing should be based on two key factors: company performance and the owner’s concerns.

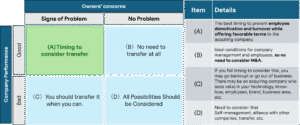

To help business owners make a well-informed decision, we introduce the concept of an M&A Decision Matrix. This framework enables business owners to assess when it’s the right time to consider M&A based on their company’s performance and the underlying personal concerns they may have. Let’s take a closer look at the four potential scenarios in the matrix:

The M&A Decision Matrix

This matrix divides the decision-making process into four distinct scenarios, each with its own unique set of recommendations. By categorizing your company’s performance and evaluating your concerns as an owner, you can make a more strategic and informed choice about pursuing M&A.

The M&A Decision Matrix

Scenario 1: Good Company Performance & Signs of Owner Concerns

Recommendation: Consider a Transfer (M&A)

Company Performance: Strong. Your company is growing, profitable, and on track.

Owner’s Concerns: Growing concerns like market changes, succession planning, burnout, or a desire for a change in lifestyle.

Even if your company is performing well, this scenario suggests it may be time to consider a merger or acquisition. Why? While the company’s performance is strong, the owner’s personal concerns may create risks in the near future. If concerns such as burnout, market shifts, or succession planning are left unaddressed, they can affect the company’s long-term stability.

An owner’s concerns can affect decision-making, employee morale, and overall productivity. If you’re feeling overwhelmed or uncertain about the future, it’s essential to act while your company’s value is high. Selling or merging at this stage can attract strong buyers and prevent the risk of future decline, especially if concerns lead to demotivated employees and potential turnover.

Actionable Insight:

Now is the time to capitalize on your company’s success while maintaining momentum. If you want to explore your M&A options, contact us today. We can guide you in making the best decision for both your business and your future.

Scenario 2: Good Company Performance & No Owner Concerns

Recommendation: No Need to Transfer

Company Performance: Strong, with consistent growth, profitability, and market position.

Owner’s Concerns: None. You’re content with the direction the company is heading and have no personal concerns about the future.

In this scenario, the company is performing well, and the owner feels no major concerns or pressures to exit the business. When both the business is thriving and the owner is satisfied, there’s typically no immediate need to pursue M&A. Your focus should remain on growth, profitability, and further strengthening your market position.

Actionable Insight:

The company is positioned for continued success. Instead of rushing into an M&A, continue to focus on innovation, scaling, and expanding. If you’re looking for ways to expand even further or develop strategic partnerships, contact us to explore growth opportunities without needing an M&A.

Scenario 3: Poor Company Performance & Signs of Owner Concerns

Recommendation: Transfer as Soon as Possible

Company Performance: Weak. Sales are declining, profitability is down, and market share is shrinking.

Owner’s Concerns: Serious personal concerns about the company’s survival, including financial stress, management challenges, or fears of business closure.

This is the most urgent scenario. If your company is struggling, and you, as the owner, have serious concerns about the future of the business, it may be time to explore M&A options immediately. While it may seem like a daunting situation, there could still be buyers who see potential value in parts of your business, such as technology, brand recognition, or skilled employees. Waiting too long could lead to further deterioration of the business and, potentially, bankruptcy.

Actionable Insight:

Don’t wait until the company reaches a point of no return. If you’re feeling the pressure of declining performance and have concerns about the company’s viability, now is the time to act. Contact us to learn more about how we can help you navigate an M&A deal before it’s too late.

Scenario 4: Poor Company Performance & No Owner Concerns

Recommendation: Explore All Possibilities

Company Performance: Weak. The company is experiencing losses, low profitability, or market share decline.

Owner’s Concerns: None. Despite poor performance, the owner is not particularly concerned, possibly due to a belief that the business can turn around or that external factors are at play.

In this scenario, the business owner is not overly concerned, despite the poor performance of the company. While this may seem like a passive approach, it is important to take a step back and assess all available options. The owner may need to evaluate strategies for self-management, restructuring, strategic partnerships, or potential alliances. This scenario requires a comprehensive review, as selling or merging may not always be the best or most immediate solution.

Actionable Insight:

Even though the company’s performance is lacking, there’s still hope for recovery. Explore options like restructuring, strategic partnerships, or seeking expert guidance to improve operations. Need help evaluating your options? Contact us to start a detailed evaluation of your business’s future.

Key Considerations in Making the M&A Decision

When deciding if M&A is the right strategy, it’s critical to honestly assess your company’s current performance and your personal concerns as an owner. Start by evaluating the financials, customer base, market trends, and operational health of your business. In addition, reflect on your personal feelings about the business—are you passionate and motivated, or are you feeling burnt out, stressed, or unsure of the future?

Another important factor is professional advice. M&A is complex, and making the right decision requires expertise. Consulting with M&A advisors, legal professionals, and financial experts is essential to navigating the process, from assessing company value to negotiating with potential buyers.

Conclusion: Timing Is Everything in M&A

Ultimately, the best time to pursue M&A is when you’re prepared—both as a business and as an owner. The M&A Decision Matrix offers a clear framework for determining whether now is the right time to sell, restructure, or explore other strategies.

Timing is crucial in M&A transactions. Whether you’re considering selling your business or seeking new opportunities, making the right decision at the right time can have a lasting impact on your business’s success.