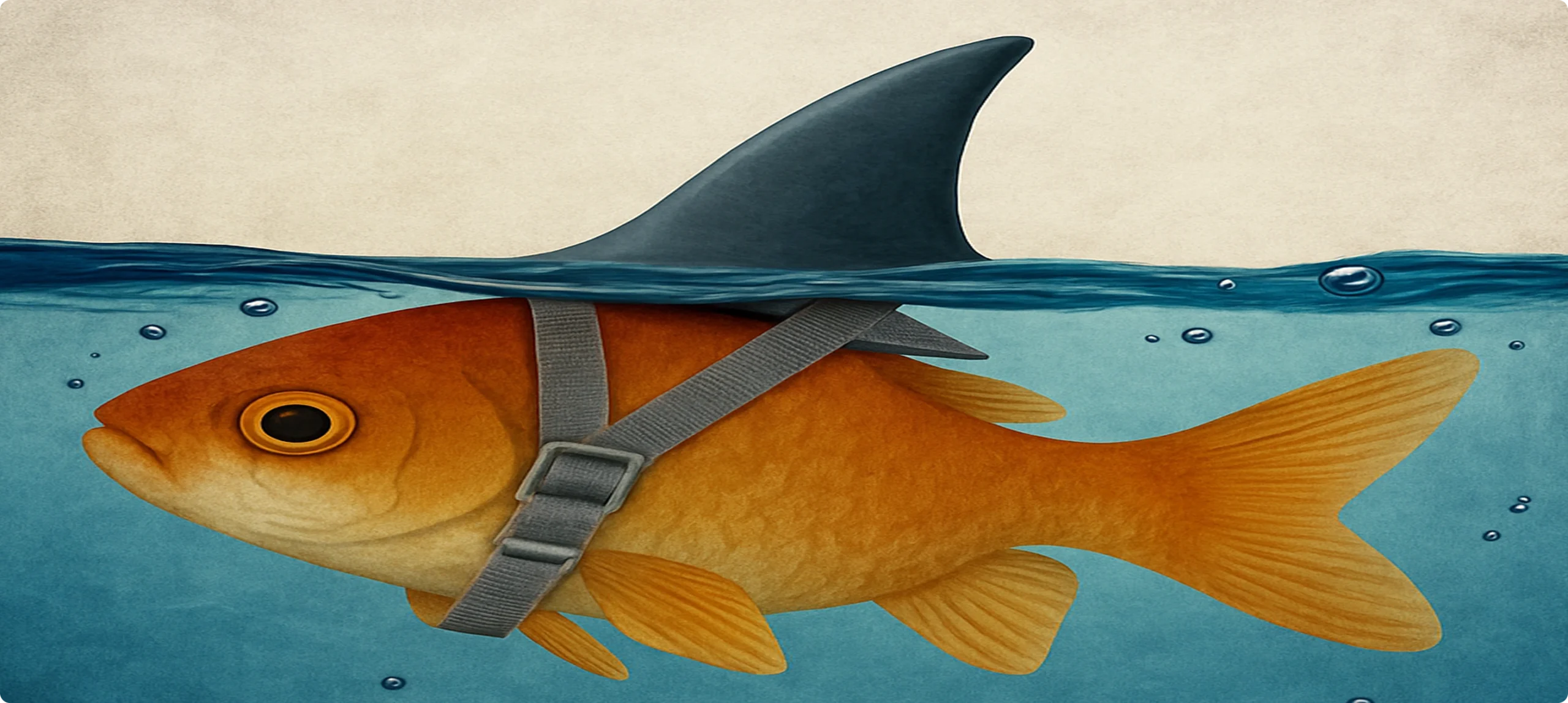

Mergers and acquisitions (M&A) are popular business strategies, but they are often misunderstood. While both involve combining businesses, mergers create a new entity, whereas acquisitions allow one company to take control of another. This article explores the key differences between mergers and acquisitions, offering practical insights for SMEs considering these growth strategies. Whether you’re looking for collaboration or direct expansion, understanding these concepts is critical to making informed decisions.

Exploring Mergers

A merger occurs when two companies of similar size combine to form a single, stronger entity. This often happens to achieve mutual benefits like cost efficiency or market leadership.

- Example: Company A and Company B merge to form Company AB.

- Benefits:

- Shared resources and expertise

- Reduced competition

- Economies of scale

Discover how mergers can drive your SME’s growth. Talk to Us for tailored insights.

Understanding Acquisitions

An acquisition is when one company takes control of another, either by purchasing shares or assets. The acquired company may operate independently or be absorbed into the buyer’s structure.

- Example: Company A acquires Company B, making Company B part of its operations.

- Benefits:

- Fast entry into new markets

- Access to proprietary technology or talent

- Greater control over integration and direction

Considering an acquisition? Get in Touch for a detailed discussion about this strategy.

Mergers vs. Acquisitions: Key Differences

| Aspect | Merger | Acquisition |

| Control | Equal partnership | Buyer gains control |

| Structure | New company formed | Existing company absorbs target |

| Purpose | Collaborative growth | Strategic expansion |

Conclusion

Both mergers and acquisitions offer unique pathways for growth. SMEs must weigh the pros and cons of each to decide which strategy aligns best with their goals.